Balancing Proof and Story in Investor Relations

Balancing Proof and Story in Investor Relations

Reaching investors is tough. They’re a selective audience, and reliable research on how they respond to communication is scarce. So when I came across a new study called Business-to-Investor Marketing: The Interplay of Costly and Costless Signals, it felt like a breakthrough.

At its heart, the research argues that investor trust depends on balancing two kinds of signals:

Costly signals (the proof):

These are the hard facts that show your business is credible and capable of delivering results. Examples:

- Strong financials and growth metrics

- A leadership team with a proven track record

- Patents, R&D, or partnerships with respected institutions

Costless signals (the story):

These shape how investors feel about the facts. They don’t create new achievements, but they make existing ones resonate. Two key types are:

- Passion: energy and conviction that show belief in the company’s future

- Concreteness: vivid, relatable communication that makes results and opportunities easy to grasp

A good example of concreteness comes from OpenAI’s Economic Blueprint They compared the investment and policy changes needed for AI adoption to America’s earlier transition to cars. By linking something new to something familiar, they made AI feel less daunting and more inevitable.

Why balance matters

If you lean too much on story without proof, it feels like hype. If you rely only on data, it feels cold and uninspiring. The sweet spot is where evidence and narrative work together — giving investors both confidence and motivation.

A simple tool

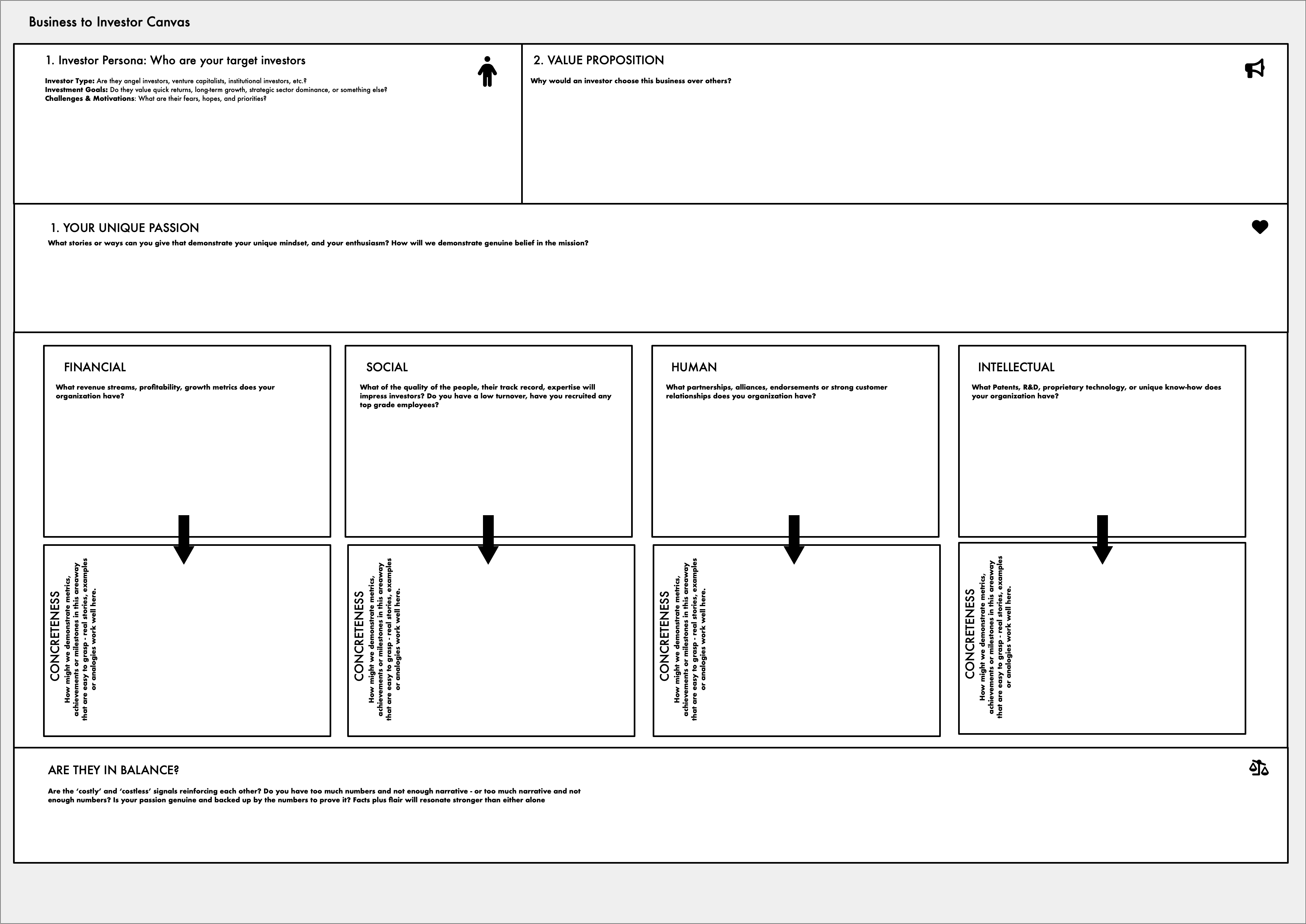

To make this practical, I’ve created a “Business-to-Investor Canvas” — a cheat sheet for balancing proof and story when shaping investor communications. My plan is to use it as a framework over the coming months to test and refine messages.